does doordash do quarterly taxes

For 2021 all employers must withhold 62 for Social Security and 145 for Medicare from employees gross wages. I save about 25 of my DD earnings in a separate account.

Makenzie Way 2020 Graduate Of Penn Law Reached Out To Mike Sims President Of Barbri To Get The Answers To H Organizational App Phone Deals Wedding Planning

FICA covers social security taxes 62 and Medicare taxes 145.

. If you expect to owe the IRS 1000 or more in taxes then you should file estimated quarterly taxes. Independent contractors still owe these taxes but are considered self-employed. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US.

Since youre an independent contractor you might be responsible for estimated quarterly taxesespecially if DoorDash is your sole source of income. As an independent contractor the responsibility to pay your taxes falls on your shoulders. Im new to this independent contractor business and come from the corporate world so not familiar with the concept of quarterly taxes.

Dont let that stress you out over the years HR Block has helped hundreds of thousands of gig workers like you. The short answer is yes. Restaurant owners are then required.

Your cash tips are not included in the information on the 1099-NEC you receive from Doordash. This sounds like a real drag but actually its a blessing in disguise. Ready to grow your business.

The Federal Insurance Contributions Act FICA requires a tax on employees wages as well as contributions from employers in order to fund the USs Social Security and Medicare programs. Ad Reach new customers and increase your restaurant margins with DoorDash. Each quarter youre expected to pay taxes for that quarters payment period.

However you still need to report them. Do I Have to Pay Taxes for DoorDash. Taxes in Retirement.

Instead Dashers are paid in full for their work and must report their DoorDash pay to the IRS and pay taxes themselves when it comes time. As such DoorDash doesnt withhold the taxes for you. If youre a Dasher youll need this form to file your taxes.

Calculate your income tax and self-employment tax bill. DASH-1100 released its latest quarterly results on May 5. If Dashing is a small portion of your income you may be able to increase your income tax withholding at your day job instead of paying quarterly taxes.

As an independent contractor reporting self employment tax these are required. Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021. There are four major steps to figuring out your income taxes.

The good news was the business continued to generate strong growth. Do you owe quarterly taxes. This means that as a DoorDash driver youll file taxes and report income on your own.

Why is this important. When you work as an employee your job withholds income taxes from your paycheck and submits them to the appropriate taxing authorities for you. Self-employed DoorDash Dashers pay their FICA Federal Income Insurance Contributions alongside their standard federal taxes.

Doordash drivers who made less than 600 in 2021 wont receive a 1099 form. Apply previous payments and credits to the tax bill and figure out if you pay in or get a refund. If you fail to pay your.

The forms are filed with the US. Eventually the IRS will send you a notice and assess taxes based on your gross revenue from DoorDash which will no doubt be a much greater amount than had you just reported the income on your tax return and taken the relevant. Does DoorDash Take Out Taxes.

Ended up only owing IRS about 250 so essentially had 1250 in tax returns which is about my usual amount. Federal income taxes apply to Doordash tips unless their total amounts are below 20. Quarterly estimate tax payments are due January 15.

One of the most common questions Dashers have is Does DoorDash take taxes out of my paycheck The answer is no. No because Dashers are not employees DoorDash does not withhold FICA taxes from their paycheck. Reduce income by applying deductions.

I have a w2 job and DD is just a side thing. How do Dashers pay taxes. Add up all of your income from all sources.

Start with the 4000 of income and subtract your auto mileage expense at the standard mileage rate of 575 cents per mile. 7 hours agoDoorDashs top line was impressive. If you wait until April to pay you could have to pay a penalty if you owe.

DoorDash does not take out withholding tax for you. My understanding is that 1099 individuals who anticipate having to pay over 1000 in taxes at the end of the year must pay quarterly taxes in addition to the year-end tax process. Drove a total of 500 miles in 2020 to make your DoorDash deliveries and.

There is also no withholding. Up to 8 cash back At DoorDash we promise to treat your data with respect and will not share your information with any third party. Yes - Cash and non-cash tips are both taxed by the IRS.

Only drivers who earned 600 or more in 2021 will receive their 1099-NEC. You can unsubscribe to any of the investor alerts you are subscribed to by visiting the unsubscribe section below. Paper Copy through Mail.

If you experience any issues with this process please contact us for further assistance. If youre purely dashing as a side hustle you might only have to pay taxes one a year. Doordash will send eligible drivers one tax form.

E-delivery through Stripe Express. - All tax documents are mailed on or before January 31 to the business address on file with DoorDash. If you will owe money on taxes this year you really want to think about getting a payment sent in by tomorrow if you havent already done so.

What Tax Forms Will DoorDash Send Their Drivers. Had no other expenses of being a DoorDash driver other than your auto mileage then this is your 2020 federal income tax. Atention Grubhub Doordash Postmates Uber Eats and other Delivery Drivers who work as Independent Contractors.

These quarterly taxes are due on the following days. Dashers should make estimated tax payments each quarter. It may take 2-3 weeks for your tax documents to arrive by mail.

US tax perspective-If you dont file taxes for DoorDash the same thing happens that would if you did not file taxes for any other income stream. Last year made 7k from DD and saved about 1500 hundred for tax purposes. Do you pay taxes on Doordash tips.

Internal Revenue Service IRS and if required state tax departments. Here are the due dates for 2021. Make sure to pay estimated taxes on time.

- If you are eligible for e-delivery you will receive an email invitation the subject of the email is Review your.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

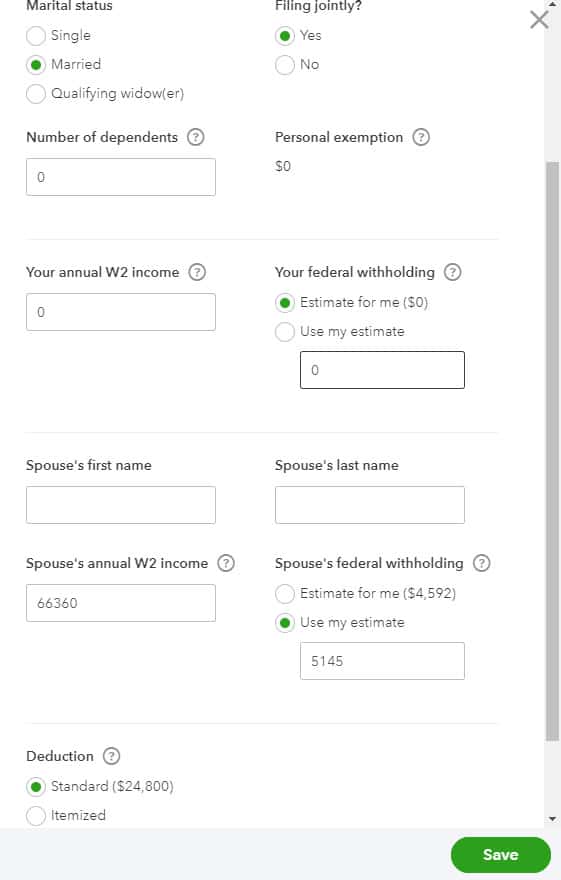

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

Doordash Taxes 2022 A Complete Guide For Dashers By A Dasher

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

2021 Federal State Tax Deadline Extension Update Picnic S Blog

How To File Your Taxes For Door Dash Drivers In 2022 Mileage Tracker Tax Deductions Tax

![]()

How To Unlock The Fm Radio Hidden On Your Smartphone Uber Smartphone Travel Tips

8 Essential Things You Should Know About Doordash 1099

How To Unlock The Fm Radio Hidden On Your Smartphone Uber Smartphone Travel Tips

How To Understand Car Expenses Vs Standard Mileage Rate Deductions For Taxes In 2022 Tax Write Offs Deduction Understanding

How Do I File Doordash Quarterly Taxes Due Septemb

A Beginner S Guide To Filing Doordash Taxes 4 Steps

How Does Doordash Do Taxes Taxestalk Net